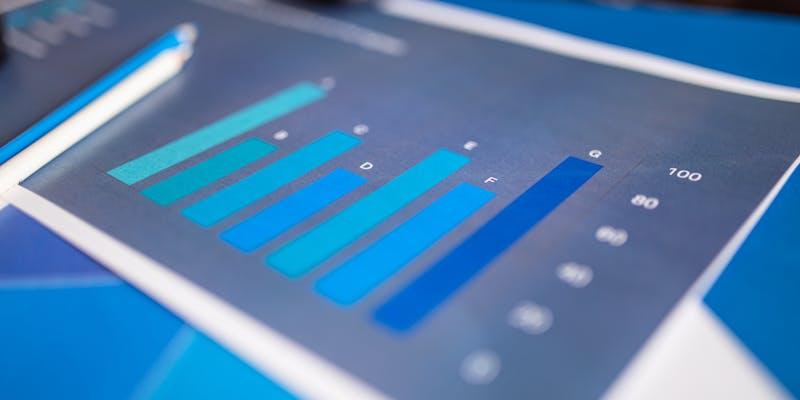

Between 2021 and 2022, the U.S. Small Business Administration reported about 1.4 million new small businesses. That era saw 447,519 more small enterprises open than close. Following the pandemic and massive employment loss, there was a noticeable trend towards entrepreneurship, and this rise reflects that.

Small companies underpin communities and produce millions of jobs in the US economy. Small businesses have created two-thirds of new U.S. jobs in the previous 25 years, which is valuable. These businesses boost local economies by giving new startup investment opportunities.

How Much Should You Invest in a Small Business?

Remember that there are financial restrictions when determining how much to invest in a small firm. You have to abide by severe laws if you want to utilize equity crowdfunding services. Moreover, owing to the associated risks, the startup investment limits are applicable:

- You can contribute up to $2,500 or 5% of your income or net worth every year, whichever is greater.

- With at least $124,000 in annual income and net worth, you may contribute 10% of either up to $124,000.

Steps to Invest in Small Businesses

To learn how to invest effectively in small businesses, weve got a thorough guide for you:

1. Find the Right Deals

The first step in investing in a small business is determining the best prospect. Investigate options in your current network first. You can meet small businesses looking for investors via social media, networking events, and neighborhood associations like the SBA or Chamber of Commerce.

Usually, some companies might not look for startup investments because they can't part with their ownership or because of financial barriers like outstanding debt. Consequently, it is crucial to consider each option carefully. Before making a choice, take your time to assess any organization's financial stability and market potential. Not every chance will repay your investment in startups.

2. Do Your Research

Extensive study is necessary before making any kind of investment in startups. Start by analyzing the business strategy, determining the company's development potential, and identifying the dangersAnalyse financial variables such as market prospects, cash flow, and existing loans. Raise essential questions about projected returns, the scalability of the firm, and the use of your money.

Knowledge of the company's operations, finances, and market positioning can help you make crucial decisions. Investigations into the owners of the company's past can also be required. Also, ensuring the company fits your investing objectives requires thoroughly understanding its advantages and disadvantages.

3. Understand Funding Sources

Any potential investor needs to know the small businesses' funding sources. Companies can get money from business loans, venture investors, debt, and stock. Examining the company's debt, assets, and bills can help you decide if it is a good purchase.

In addition, you need to look at the company's cash and default state; monitoring the company's finances could also lower the risks of your purchase. Understanding the business's funding method thoroughly gives you a good idea of its long-term growth and survival.

4. Review the Business Plan

Investors should know the company's financial source. Important information should be included, like cash flow accounts, economic forecasts, market studies, and sources of income. This plan makes it easy for investors to understand what the company does, its goals, and how it is set up. Studying the business plans and objectives of the year or even a decade can help you know how your startup investment will pay off. You should also observe whether they are ambitious or not.

Additionally, marketing plans, law company setups, and management skills must be carefully examined. Before investing in small businesses, it is crucial to thoroughly explore its plan, which acts as a guide for achievement.

5. Meet the Management Team

A company's progress depends on its management team. Before making investments in startups, take your time to carefully consider their credentials, knowledge, and ability to lead. Ask these questions for a better understanding:

- Do they know how to lead the company to its goals?

- Does their goal match their motivation?

- Does their motive match with yours?

- Is the small business goal-oriented?

Knowing their connection and how they work together is very important. Furthermore, consider signs of decent behavior, good leadership, and the ability to solve problems. Also, ensure the management team is fully committed to the company's success and has the skills to carry out the business plan.

6. Negotiate Terms

Conditions must be negotiated before investing in small businesses. If you're giving stock funding, you should review your profit-sharing, vote rights, and ownership stake. When investing in debt, consider the loan amount, the interest rate, and the planned payback schedule.

Moreover, having a lawyer help with the writing ensures that all rules are clear and can be enforced. Ensure all the deal details have been carefully reviewed and agreed upon before you finalize the deal. Also, getting good terms could mean the difference between a profitable investment and a loss, so paying close attention is essential.

7. Understand Your Exit Strategy

Before investing, you should know how you will get your money back. If you have a clear exit plan, you'll learn how to get your money back, whether it's through earnings, coaching fees, or selling your shared ownership.

Moreover, knowing how your earnings will show up on your tax returns and whether you need to send in extra tax forms, like a K1 partnership return, is essential. Contact your lawyer or tax expert to ensure your startup investment fits your financial goals. Also, an organized plan for how and when to take your money from the business is necessary to make intelligent financial decisions.

8. Finalize the Deal

After the terms are agreed upon, the next step is to close the deal with the selected small businesses. The agreed-upon funds must be transferred, and the necessary formal papers must be signed. Include articles of formation, loan documents, and stock agreements in the papers you save.

Usually, these papers protect your rights as an investment and formalize the deal. You are not arguing as much in the future when everything is written down. For your investment to go ahead with trust, the deal must be well-structured and backed up by legally binding papers that spell out everyone's duties.